Frequently Asked Questions

-

Can I process internationally with TIB Finance?

Absolutely. As of right now, TIB Finance can process payments in the United States, Canada and Mexico. We are looking to expand our operations into Europe in the next year. Stay tuned!

-

Do you offer a trial period?

From time to time, we offer businesses a one-month trial period during which you can access our services through TIB’s platform or TIB’s API and start using them entirely free.

-

Are there minimum commitments or hidden costs?

No. With TIB Finance, you only get charge $25 a month to access the services. While other companies work hard to find new ways to quietly add to your costs, at TIB Finance we pride ourselves on transparency and be a true payment partner for your business.

-

I own a little accounting firm, can I use TIB’s finance

services to collect my customer payments?

Yes. TIB’s finance services give you the opportunity to forget the old collection way that implies your mailman. You only need to add the Client’s email customer email, amount $ CAD enter the customer payment amount due, E-Check, Credit Card E-Check or Credit Card choose the payment methods you want to allow and validate the transaction. Your customer will then receive an email that will ask him to choose the preferred payment methods, if possible, to add its payment information and to validate the transaction amount. Once the information collected and the transaction accepted by your customer, the payment will be deposited in the next 24 hours directly into your accounting firm bank accounts. For the following payments, depending on the current customer contact, you’ll be able to perform transaction directly from your end without the implication of your customer.

-

I want to be sure that my customer does have money in their

bank account before initiating a perception.

TIB finance instant bank verification (IBV) module allows you to verify in real time your customer’s bank balance so you’ll maintain a good relationship.

-

In step 2, how do I generate the symmetric key on the client

side using a byte array Guide?

In step 3,is 'RSA asymmetric key on 1024 bits' the same key generated in the first step?

how do I convert the key to a byte array?The SDK lets you Use the Endpoint of the Platform without having to do all the extra work of encrypting Keys and converting them.

We have SDKs For multiple languages:

.net Core - .net Framework - php - Javascript (Client side) - and node Js (Server side). -

How do I get back the money that is in the Wallets?

For example, if we had to withdraw one of our client companies from our TIB account, where would the money in its wallet go?Customers should call us to tell us where to refund the wallet. However, Wallet control will soon be available via the API and portal.

-

Do I need to store a Pre-Authorized debit authorization to

process recurring transactions?

Pre-Authorized Debit (PAD) is a payment method whereby your customer authorizes your business to automatically withdraw from its bank account. The authorization needs to be stored by law and reachable if needed. TIB finance offers a PAD consent collection service that frees your mind from that legal nightmare and lets you perform the desired payment smoothly.

-

I don’t have my customer banking information and don’t want

to handle that sensitive infomartion on my side.

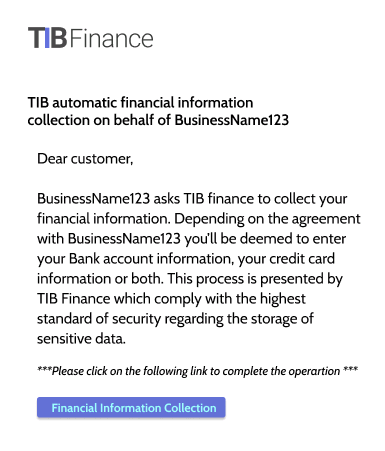

When adding a new customer, you can add their financial information from your side or you can let TIB finance collect the information automatically by email. Your customer will receive an email like the following. You can modify the content so the customer will only see your brand.

-

I made an error and want to refund a customer

Find the pay section on the side menu, select the customer, enter the amount to be refunded and validate the transaction.

-

What’s appearing on the customer bank statement?

You can update at any time, the payment description so your customers will easily recognize your business-related transactions.

-

I own few buildings, can I set tenants for recurring bank

account debit?

TIB finance allows you to program recurring collection easily and securely on the frecuency of your choice. It’s even possible for you to debit your tenant credit card in case of non-sufficient funds.

-

In step 5, if the encryption method used is a bit obscure,

here is more explanation about the RSA algorithm used and

how it works.

I invite you to visit our website tib.finance. On the developer page, you will find an API updates section.

In this section you will finda section called TIBPhPSDK, you will find documentation that will help you answer all your questions. -

If you want to test the API, and before using the SDK, you

should configure the API URL to have the session ID. Here

are the steps:

Using the SDK, the following calls must be made:

SetURL("http://sandboxportal.tib.finance");

CreateSession(yourClientId, Username, Password);

get the session Id then you can make the other Calls, see the github for more information about the SDKs. -

Can a merchant have multiple bank accounts?

No, the merchant is synonymous with "bank account" in the system.

-

How do I switch from one bank account to another?

There are not multiple accounts for one merchant.

-

How do I switch from one bank account to another?

There are not multiple accounts for one merchant.

-

How do customer payments to TIB work?

Considering that there would be several marchands.There are several possible scenarios.

If you do your boarding once, you can create 4 merchants for each company.

However, the limits, guarantee amounts, etc. will be common to the 4 merchants.

And also, you can only have multiple accounts to not bargain.

The ideal is to create a service (sub-client) for each of your companies.

Thus, each of the companies would have its own limits and would therefore be in some way independent.

Explanation of the hierarchy:

- Client: Master Account and User/Password to make transactions

- Service : client principal

- Merchant: Primary customer's bank account

- Service: Lending Company A

- Merchant: Company A's #1 bank account

- Service: Lending Company B

- Merchant: Company B's #1 bank account

- Merchant: Company B bank account #2

Possibility #1

You can board online for each of the lending companies. We will do what is necessary to put them all below the same customer account. So you have to do a first "boarding" for main customer and then do the others.

Possibility #2

You can let yourself create your "service" sub-accounts using the "CreateSubClient" method of the API.

However, there will be default limits that will be affected.

All services will share the limits placed at the client level.

So if lender A takes the whole limit, lender B will not be able to operate.

Once created in this way, transactions are added to the system specifying for which merchant/service. -

Protection of TIB systems: What are the limits applied to

transactions?

The TIB system applies several limits to control transactions:

- Maximum per transaction

- Maximum per day

- Maximum per month

- Different limits for credits and debits

- Ability to apply limits on files transactions (ACP_005) -

Protection of TIB systems: What happens when a limit

reached?

A detailed email is sent to the manager account.

The transaction can be suspended and released manually.

Another limit (e.g. monthly limit) can still block the transaction after release. -

Protection of TIB systems: How are the limits in the system?

Limits are applied in sequence:

1. Checking the maximum amount per transaction.

2. Checking daily limits.

3. Checking monthly limits. -

TIB Systems Protection: How Management Works permissions?

The system requires double authentication for any significant modification:

- Adding or editing a deposit account

- Editing Contact Information

- Adding a user

- Release of suspended transactions -

Protection of TIB systems: What are the actions considered

high risk?

- Changing a Merchant's Limits

- Release of out-of-bounds transactions

- Activation of “Free Deposit” mode -

Protection of TIB systems: How the analysis works real time?

The system analyzes trends to detect anomalies :

- Amount of transactions compared to histories

- Abnormally high number of transactions

- Abrupt changes in transaction dates

- Increase in the number of new accounts or manual releases -

Protecting TIB Systems: How to Access Security is she

insured?

- Double authentication required

- Restriction of access by IP or VPN

- Logging of all actions

- Securing access -

TIB Solutions: What are the main problems in the payment

management?

- Modernization of complex payment processes

- Faulty interconnection requiring interventions human

- Manual reconciliation slowing down operations

- Complex payment default management

- IT security requiring investments massive -

TIB Solutions: How TIB makes it easier to manage payments?

- TIB Solutions: How TIB makes it easier to manage payments?

- Automation of bank flows and reconciliation

- Support for all payment types and methods electronic

- Maximizing supplier relationships and delivery options payments

- Recovery automation and default management -

TIB Solutions: What are the benefits of TIB integration ?

- Process automation without additional effort

- Reduction in operational costs and increase in velocity

- Competitive transactional fees

- Fast implementation time (~0 to 2 weeks)

- Possibility of operating as a white label -

TIB Solutions: What consulting services are offered by TIB ?

- Auditing and certification

- Consulting (strategy, analytics, operations, capital human)

- Risk management (internal controls, cybersecurity, regulation)

- Financial advice (mergers and acquisitions, forensic accounting, taxation, legal) -

TIB Solutions: How the integration of payments with TIB?

- Connection to management software

- Definition of accepted payment methods

- Automation of recurring and one-time payments

- Automatic recovery system -

Why adopt electronic payments?

- Transformation of commerce through digitalization

- Speed, security and automation of payments

- Archaic and limited banking infrastructure -

What are the main challenges of electronic payments ?

- High cost of current solutions

- Complex integration requiring expertise technical

- Lack of flexibility of payment facilitators

- High fees per transaction (up to 4.32% depending on IDC study) -

How does TIB Finance respond to these challenges?

- Fast integration with open API

- Fixed pricing for bank payments

- Flexibility in payment management

- Automation without manual intervention -

What business models can use TIB Finance?

- E-commerce (e.g. Wayfair)

- SaaS (eg. Dropbox)

- Marketplace (eg. eBay)

- Service platform (eg. DoorDash) -

What types of payments are supported?

- Direct deposits and withdrawals (EFT, ACH, DRD)

- Credit cards

- E-check

- Recurring or unitary bank direct debits

- Batch Interac payments -

What are the financial advantages of TIB Finance?

- Fixed pricing, even for $1 or $10 transactions 000 $

- High volume savings

- No fixed fees, pay as you go -

How does TIB Finance improve payment management?

- Dashboard for real-time monitoring

- Process automation (error detection, automatic reminders)

- Save time by reducing manual management -

What level of security is ensured?

- Advanced cryptography and PCI-DSS compliance

- Securing transactions and data users -

What results can we expect from the adoption of TIB Finance

?

- IDC study showing an average increase in sales of 7%

- Improving customer experience and reducing costs payment deadlines

- Rapid integration of partners and suppliers -

TIB Finance Portal: How to access the TIB Finance Portal ?

- Production: http://portal.tib.finance

- Development: http://sandboxportal.tib.finance -

TIB Finance portal: What are the main portal features?

- Online transaction management

- Adding and editing bank accounts

- Creation and monitoring of supplier and customer payments

- Validation of bank accounts

- Integration with software via API -

TIB Finance Portal: How to manage your bank accounts?

- Consultation, addition and modification of accounts

- Automatic information verification

- Provisioning and validation before activation -

TIB Finance portal: Can we add clients and suppliers?

- Yes, and payment methods can be associated with each

- Ability to configure so that the customer/supplier enter your banking information -

TIB Finance Portal: How the management of payments and

invoices?

- Generation of invoices for customers and suppliers

- Setting up recurring or one-time payments

- Automatic email sending for information entry banking -

TIB Finance Portal: What are the limits and possible

approvals?

- Configuring payment limits

- Notifications in case of overrun for validation manual -

TIB Finance Portal: Can we track transactions in real time?

- Yes, via a statistical dashboard allowing to analyze transactions

-

TIB Finance Portal: How the file deposit works ACP for batch

payments?

- Support for ACP 120 and ACP 1464 formats for processing in mass

-

TIB Finance Portal: How to validate a bank account?

- Automatic verification to avoid errors (NFS, objections, etc.)

- Independent validation API available -

TIB Finance Portal: How to integrate the TIB Finance portal

in software or a website?

- API with endpoints for payments, accounts, validation, etc.

- SDKs in .NET, PHP, Python, JavaScript

- Integration possible via secure iFrame -

TIB Drop-In: What is TIB Drop-In?

Drop-In is a JavaScript library that allows to integrate an iFrame on a web page to process payments under a merchant account.

-

TIB Drop-In: How does Drop-In work?

- Server calls TIB API to get token unique.

- The token is embedded in the HTML page.

- The script injects the Drop-In iFrame to process the payment. -

TIB Drop-In: What types of payments are supported?

- Credit card (number, expiration, CVV)

- Bank account (transit number, selection of bank)

- Recurring customers (recorded payment)

- Multiple selection if more than one is available methods -

TIB Drop-In: How to get a server-side Drop-In token?

- Create a session via the TIB API.

- Use the GetDropInPublicToken method with the token session to collect a Drop-In Token.

- Each payment requires a new token. -

TIB Drop-In: How to integrate Drop-In on the client side?

Include the script:

<script src="http://sandboxpublic.tib.finance/CDN/Dropin/DropIn_1.0.js"></script>

Inject the iFrame with:

TIB_Dropin.LoadIframe({ elementid: "DestinationDivId", publictoken: "7c7c0216-985b-4705-824b-00a8d838dfd0", lang: 'fr' }); -

TIB Drop-In: Can we customize the appearance of the Drop-In?

Yes, you can change the styles (button colors, menu style, font, etc.) by passing a style object to TIB_Dropin.LoadIframe.

-

TIB Drop-In: How to handle drop-in events transaction?

You can define callbacks for success or error, for example example :

TIB_Dropin.LoadIframe({ successcallback: function (success) { console.log("Payment successful: ", success); }, errorcallback: function (error) { alert("Error payment: " + error); } }); -

TIB Drop-In: What types of transactions are supported ?

- Bill payment

- Deposit (credit cards are not permitted for deposits)

- Collection -

TIB Drop-In: What environments are available?

- Production: http://portal.tib.finance

- Development: http://sandboxportal.tib.finance -

TIB Drop-In: What are the configuration options progress?

- Authorization of existing payments for customers recurring

- External reference for tracking payments via API

- Dynamic language selection (French or English)